M&B Engineering Ltd, a leader in pre-engineered buildings (PEB) and self-supported steel roofing, has opened its ₹650 crore IPO for subscription from July 30 to August 1, 2025. The issue consists of a fresh issue of ₹275 crore and an offer-for-sale (OFS) of ₹375 crore by the promoters.

The IPO is priced between ₹366 and ₹385 per share, valuing the company at a post-issue market cap of around ₹2,105 to ₹2,200 crore. The proceeds will be used for capital expansion, machinery upgrades, installing solar panels, IT infrastructure, debt repayment, and general business requirements.

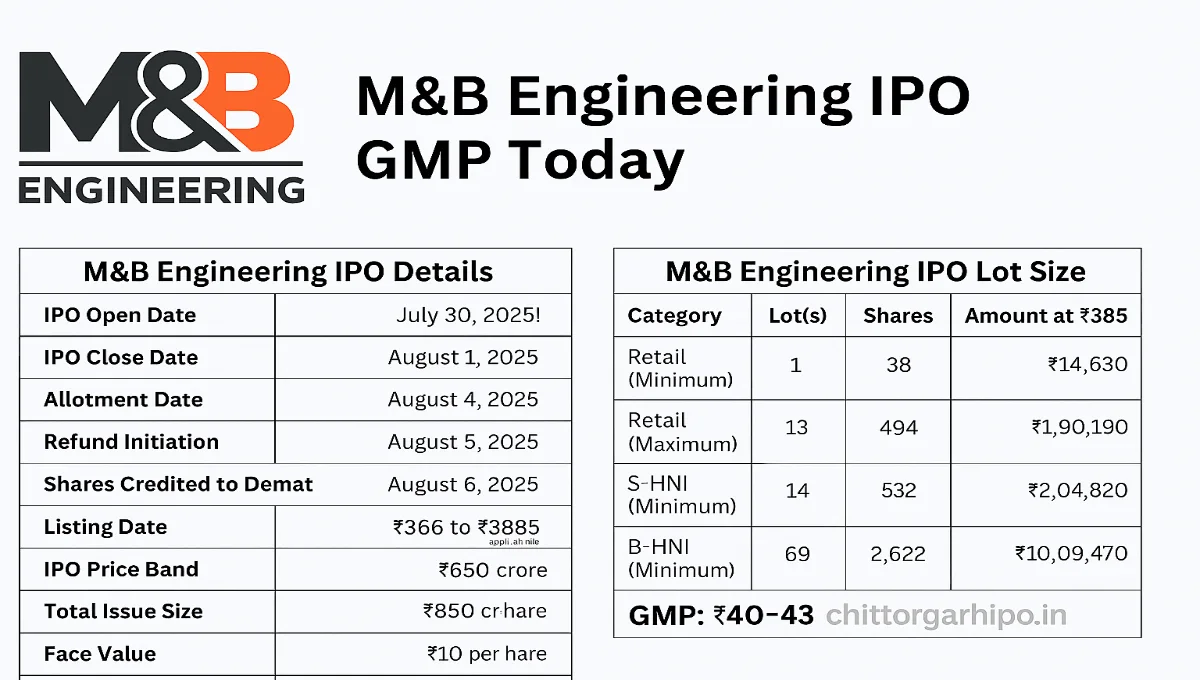

M&B Engineering IPO Details

| Particulars | Details |

|---|---|

| IPO Open Date | July 30, 2025 |

| IPO Close Date | August 1, 2025 |

| Allotment Date | August 4, 2025 |

| Refund Initiation | August 5, 2025 |

| Shares Credited to Demat | August 5, 2025 |

| Listing Date | August 6, 2025 |

| IPO Price Band | ₹366 to ₹385 per share |

| Total Issue Size | ₹650 crore |

| Face Value | ₹10 per share |

| Listing on | BSE and NSE |

| Issue Type | Book-Built Issue IPO |

M&B Engineering IPO Lot Size

Retail investors can apply in lots of 38 shares. Here’s a breakdown of the application size:

| Category | Lot(s) | Shares | Amount at ₹385 |

|---|---|---|---|

| Retail (Min) | 1 | 38 | ₹14,630 |

| Retail (Max) | 13 | 494 | ₹1,90,190 |

| S-HNI (Min) | 14 | 532 | ₹2,04,820 |

| B-HNI (Min) | 69 | 2,622 | ₹10,09,470 |

Investor allocation:

- Qualified Institutional Buyers (QIB): 75%

- Non-Institutional Investors (NII): 15%

- Retail Investors: 10%

Grey Market Premium (GMP) Toda

As of July 30, 2025, the Grey Market Premium for M&B Engineering IPO is reported around ₹40 to ₹43 per share. This suggests a possible listing price of ₹425–₹428, indicating an approximate 11% gain over the upper price band of ₹385.

Although some unofficial sources mention higher GMP, most reliable IPO tracking platforms confirm this moderate range. GMP trends are useful indicators of market interest but should not be solely relied upon for investment decisions. you should visit the – https://www.chittorgarh.com/ipo/mb-engineering-ipo/2049/

Subscription Status on Day 1

On the first day of the IPO, investor participation was strong, particularly from retail investors.

| Investor Category | Subscription (Day 1) |

|---|---|

| Retail Investors | 2.58× |

| NII (HNI) | 0.66× |

| QIB | No major bids yet |

| Total | 0.66× |

Retail investors showed strong early interest, while institutional response is expected in later stages of the IPO window.

Company Overview & Financial Highlights

Founded in 1981 and based in Ahmedabad, M&B Engineering is known for its pre-engineered building solutions and metal roofing. The company has completed over 9,500 projects and exports to more than 22 countries.

Financial Snapshot (FY25 Estimates)

| Metric | Value |

|---|---|

| Revenue | ₹988–996 crore |

| Net Profit | ₹77 crore |

| EPS | ₹13.5 |

| PE Ratio (Upper Band) | ~28.5× |

| Order Book | ₹840 crore+ |

Prominent clients include Adani Group, Tata Advanced Systems, and Alembic Pharmaceuticals. M&B Engineering is also India’s only facility certified by the American Institute of Steel Construction (AISC).

Brokerages like Anand Rathi, Arihant Capital, and Bajaj Broking have recommended the IPO with a “Subscribe for Long Term” rating.

Should You Apply for M&B Engineering IPO?

The IPO is fairly priced considering its solid fundamentals, industry leadership, and established client base. The 11% GMP, combined with strong retail interest and positive analyst reviews, make it a potentially good opportunity for long-term investors.

However, since institutional participation was limited on Day 1, investors are advised to monitor upcoming subscription data before finalizing their decision.

Always consider your financial goals and risk appetite, and consult a professional advisor before investing.

Leave a Reply