The Anondita Medicare IPO allotment is being completed today, August 28, 2025. This SME IPO, which received huge demand from investors. it was open for subscription from August 22 to August 26, 2025. With the allotment process starting, investors are eager to know whether they have received shares or not. The allotment status can be checked online through the registrar (Mashitla Securities), NSE portal and popular IPO tracking sites.

So guys, in this article we have discuss about Anondita Medicare IPO Allotment Status 2025: Check Allotment Online, Refunds & Listing Date.

Anondita Medicare IPO Highlights

- IPO Date: August 22, 2025 to August 26, 2025

- Listing Date: September 1, 2025

- Face Value: ₹10 per share

- Issue Price: ₹145 per share

- Lot Size: 1,000 Shares

- Sale Type: Fresh Capital

- Total Issue Size: 47,93,000 shares (aggregating up to ₹69.50 Cr)

- Reserved for Market Maker: 2,70,000 shares (aggregating up to ₹3.92 Cr) – Mansi Share & Stock Broking Pvt. Ltd.

- Net Offered to Public: 45,23,000 shares (aggregating up to ₹65.58 Cr)

- Issue Type: Bookbuilding IPO

- Listing At: NSE SME

- Shareholding Pre-Issue: 1,32,93,618 shares

- Shareholding Post-Issue: 1,80,86,618 shares

This Anondita Medicare IPO attracted strong interest from retail and institutional investors, and the GMP (grey market premium) also indicates positive listing expectations.

Anondita Medicare IPO Allotment Date and Timeline

| Event | Date |

|---|---|

| IPO Open Date | August 22, 2025 |

| IPO Close Date | August 26, 2025 |

| Allotment Finalization | August 28, 2025 |

| Refunds & Demat Share Credit | August 29, 2025 |

| IPO Listing Date | September 1, 2025 |

How to Check Anondita Medicare IPO Allotment Status Online

Investors can check their Anondita Medicare IPO allotment status using these easy methods:

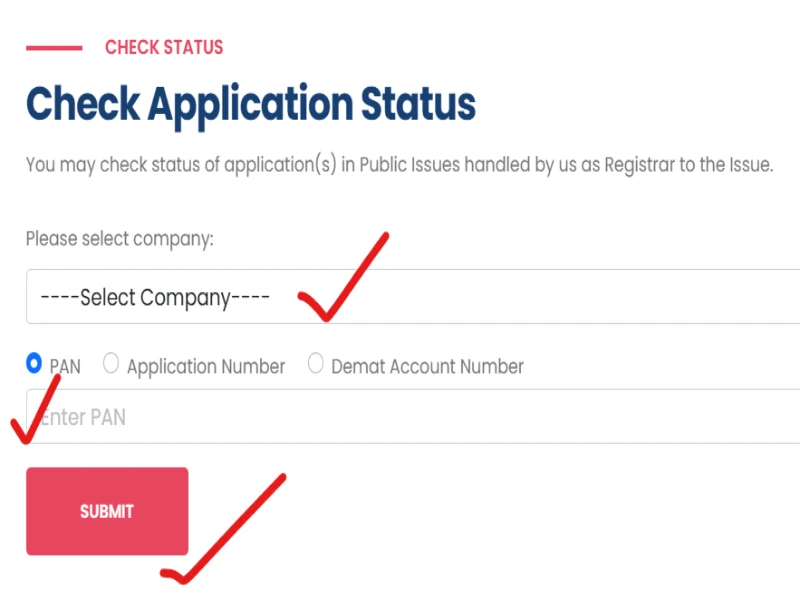

1. Registrar Website (Maashitla Securities)

- Visit the Maashitla Securities Pvt. Ltd.’s website official allotment page.

- Select company “Anondita Medicare Limited” from the dropdown.

- Enter your PAN, application number, or Demat account ID.

- Click Submit to view allotment status.

2. NSE Website

- Visit the NSE IPO allotment status page.

- Select Equity option SME IPO and choose Anondita Medicare Limited.

- Enter your PAN and application number.

- Click Search to see results.

3. Checking via Your Demat Account

- Log in to your demat or trading account through your broker’s platform (e.g., Zerodha, Upstox, or Groww).

- Go to the Portfolio or Holdings section.

- Look for Anondita Medicare IPO shares in your account. If allotted, 3,200 shares (minimum for retail) will be available by August 19, 2025.

4. Checking via Your Bank Account

- First access the bank account you used for Anondita Medicare IPO application.

- Check the transaction history or balance section.

- If the shares get allotted, the application amount will remain debited, and you may receive a confirmation SMS from your bank

- If not allotted, the blocked amount will be released or refunded by 29th August 2025.

Why investors are excited for this

Anondita Medicare’s strong financial growth and unique products like strawberry and chocolate flavored condoms have generated huge interest. The company’s eco-friendly manufacturing and partnerships with global health programs make it a promising investment. High subscription rates indicate strong demand, but this could make buying the stock competitive.

Important Information for Investor

- If allotted, shares will be credited to your Demat account by August 29, 2025.

- If not allotted, refunds will also be processed on the same date.

- The IPO will list on the NSE SME platform on September 1, 2025.

Conclusion

The Anondita Medicare IPO allotment is a important step for investors after the exceptional subscription response. With refunds and share credits happening on August 29 and listing on September 1, all eyes are now on this IPO hitting the market.

Leave a Reply