Urban Company Limited, the country’s largest tech-enabled home services platform, today opened its much-awaited ₹1,900 crore initial public offering (IPO). The issue will close on September 12, 2025, with an expected listing on September 17, 2025, on both BSE and NSE.

Urban Company IPO Details

| Particulars | Details |

|---|---|

| IPO Open Date | September 10, 2025 |

| IPO Close Date | September 12, 2025 |

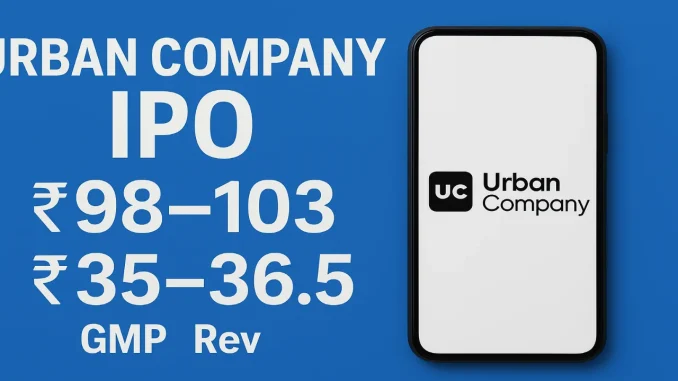

| Price Band | ₹98 – ₹103 per share |

| Issue Size | ₹1,900 crore (₹472 cr fresh + ₹1,428 cr OFS) |

| Anchor Raised | ₹854 crore |

| GMP (10 Sept) | ₹35 – ₹36.5 (~35% premium) |

| Listing Date | September 17, 2025 (tentative) |

| FY25 Revenue | ₹1,145 crore (up 38%) |

| FY25 Net Profit | ₹240 crore (includes tax credit) |

Urban Company IPO Date

| IPO Open Date | Wed, Sep 10, 2025 |

| IPO Close Date | Fri, Sep 12, 2025 |

| Tentative Allotment | Mon, Sep 15, 2025 |

| Initiation of Refunds | Tue, Sep 16, 2025 |

| Credit of Shares to Demat | Tue, Sep 16, 2025 |

| Tentative Listing Date | Wed, Sep 17, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Fri, Sep 12, 2025 |

Urban Company IPO Price Band and Issue Structure

The company has fixed its price band at ₹98–₹103 per share.

- A fresh issue of ₹472 crore will be raised by the company to support business expansion.

- An offer for sale (OFS) of ₹1,428 crore will be made by existing shareholders.

Anchor Investor Response

Ahead of this IPO, Urban Company ltd successfully raised ₹854 crore from anchor investors at ₹103 per share. Global funds such as GIC, Fidelity, Norges Bank, Goldman Sachs and top Indian mutual funds participated, strengthening institutional confidence.

Urban Company IPO Grey Market Premium (GMP) Update

The IPO has generated high interest in the grey market.

- Earlier this week, GMP was around ₹28.

- On September 9, it jumped to ₹34–₹35.

- On the opening day of the IPO (September 10), the GMP climbed further to ₹35–₹36.5, indicating a possible listing gain of about 35% over the issue price.

Urban Company IPO Subscription Status

On the first day of bidding, the IPO has received consistent participation from investors. Initial data shows partial subscription in the retail and institutional categories, and analysts expect demand to be even stronger as the issue progresses.

Financial Performance

Urban Company reported its first annual profit in FY25, reporting a net profit of around ₹240 crore on revenue of ₹1,145 crore, up nearly 38% over the previous year. However, a large portion of this profit came from deferred tax benefits. Its operating margins are improving, but valuations remain high and the P/E ratio at the upper price band is around 60 times.

Analyst View

Experts believe that Urban Company’s strong brand, scalable business model and growing customer base make it attractive in the long term. At the same time, they caution that this IPO is expensive compared to its peers and investors should be prepared for volatility.

How to Apply for Urban Company IPO: Step-by-Step Guide

As we read above, Urban Company’s IPO has opened for subscription and many investors are keen to participate in it. If you are planning to apply, you can do so in two main ways – via UPI on a broker platform or via ASBA through your bank. Below is a handy guide.

Requirements Before Applying

To apply for the Urban Company IPO, you will need:

- A Demat and trading account

- A valid PAN card

- A linked bank account with sufficient balance

- A UPI ID (if applying through broker apps)

Applying via UPI Through Broker Apps

- Log in to your trading app such as Zerodha, Groww, Angel One, or Upstox.

- Go to the IPO section and select Urban Company IPO.

- Enter the number of lots you want to apply for. The minimum lot size is 145 shares.

- Provide your UPI ID and confirm the bid.

- Approve the UPI mandate in your payment app before the IPO closing deadline.

Applying via ASBA Through Net Banking

- Log in to your bank’s net banking portal.

- Go to the ASBA IPO Application section.

- Select Urban Company IPO from the list.

- Enter the quantity of shares or lots and select the cut-off price.

- Confirm your application. The bank will block the amount until allotment.

After Applying

- If shares are allotted, the blocked funds will be debited from your account and shares will be credited to your Demat account.

- If not allotted, the blocked amount will be released back to your bank account.

Urban Company’s IPO has generated strong interest in the market, and applying through the right method ensures a smooth process for investors.

Final Word

Urban Company’s IPO has started on a strong note with solid anchor backing and a healthy GMP in the grey market. While short-term listing gains look promising, investors should weigh the high valuation risks before making a decision. Those with a long-term outlook may find it a suitable opportunity, but cautious investing is advised.

Source link – https://www.chittorgarh.com/ipo/urban-company-ipo/2425/

Leave a Reply